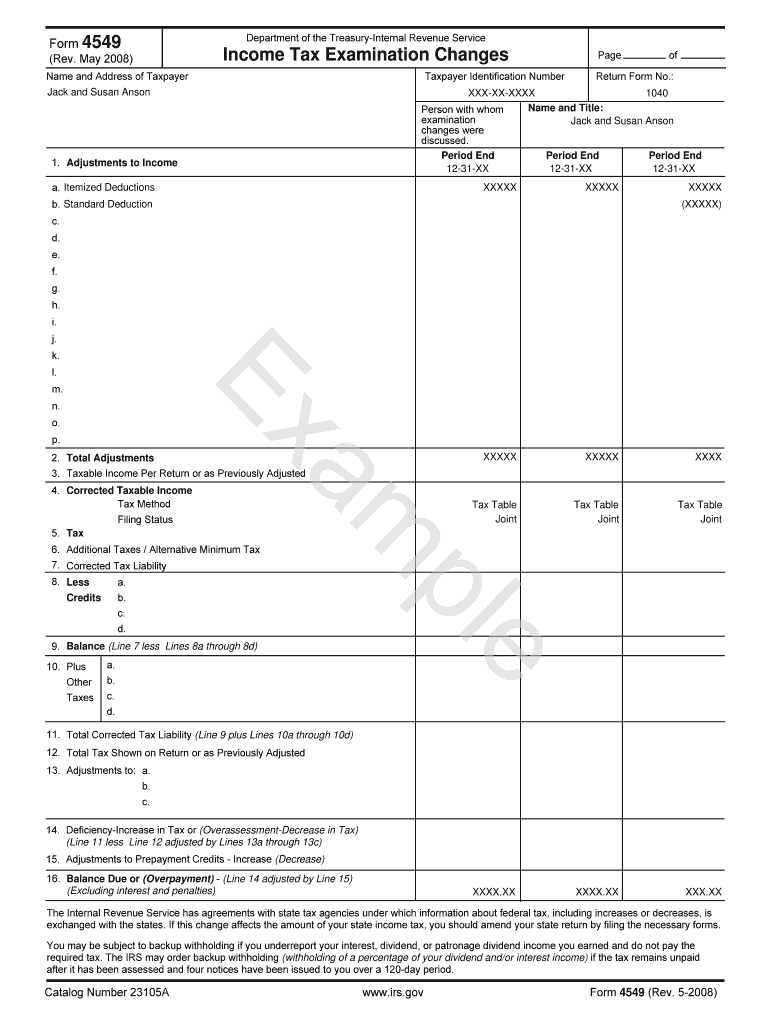

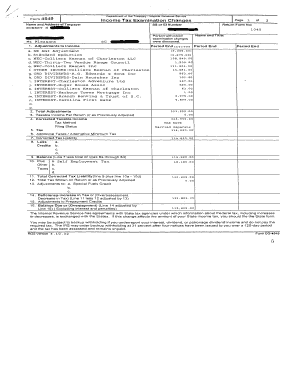

What is Form 4549 (Income Tax Examination Changes)?

IRS examines organizations or individuals to ensure that their reported tax information is accurate and follows all tax laws. IRS audits can be random or based on issues related to tax return reporting. If you received an audit letter, you must read it carefully and provide the requested information and documents via mail or fax. Based on the review, you will either get a letter that your form is accepted or a 4549 Form with proposed changes to your tax return.

How do I respond to Form 4549 IRS?

- Agree with the form’s adjustments: send the dated and signed Form 4549 along with the payment (if there was an increase in the amount of taxes owed).

- Disagree with adjustments: appeal both within the IRS and before the courts.

- Not to respond to the IRS form 4549: get a Notice of Deficiency and file a petition with Tax Court.

What information do you need for Form 4549?

When you receive the form, review the changes to your tax return proposed by IRS and choose to accept or reject them.

How do I fill out Form 4549 IRS?

If you agree with the adjustments, simply sign and date the form.

Do Other forms accompany Form 4549 IRS?

Form 4549 is accompanied by Form 886A, which provides a detailed explanation of why the IRS changed your taxpayer’s return.

How much time do I have to respond to IRS form 4549?

You have 30 days to respond to IRS.

Where do I send my Tax Form 4549?

Send Form 4549 and your payment in the same envelope you received the form.